The current state of the Bakersfield housing market leans towards a seller’s advantage, driven by factors such as swift sales, multiple offers, and homes often selling above list price. However, this does not deter buyers, as evidenced by the consistent demand and the 31% of homebuyers seeking to relocate within Bakersfield. Despite the competitive landscape, the market remains dynamic, offering opportunities for both buyers and sellers to capitalize on favorable conditions.

Current Bakersfield Housing Market Trends

How is the Housing Market Doing Currently?

The Bakersfield housing market in February 2024 exhibited a 5.4% increase in home prices compared to the previous year. According to Redfin, with a median price of $400K, homes in Bakersfield are proving to be resilient in the face of economic fluctuations. Interestingly, the median sale price in Bakersfield stands 3% lower than the national average, a factor that could potentially attract buyers looking for more affordable options.

How Competitive is the Bakersfield Housing Market?

Bakersfield’s housing market is undeniably competitive, with homes typically selling within 30.5 days. This statistic reflects a 8-day decrease from the previous year, indicating a swift turnover in property transactions. Moreover, the market sees many homes receiving multiple offers, often leading to bidding wars and, in some cases, waived contingencies. This competitive environment is further exemplified by homes selling for about 1% below list price on average, with hot properties even fetching 1% above list price. Such trends underscore the fervent activity within the Bakersfield real estate arena.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the high demand for homes in Bakersfield, the supply seems to be meeting the needs of eager buyers. In February 2024, 280 homes were sold, a notable increase from 258 the previous year. Additionally, with 22.4% of homes experiencing price drops, sellers are demonstrating a willingness to adjust to market dynamics, thereby enhancing affordability and accessibility for potential buyers.

What is the Future Market Outlook for Bakersfield?

Looking ahead, the future market outlook for Bakersfield appears promising. With a year-over-year increase in the percentage of homes sold above list price (31.1% in 2024 compared to 26.4% in the previous year), the momentum seems to be in favor of sellers. Similarly, the sale-to-list price ratio has also experienced a positive uptick, indicating continued confidence in the market’s stability and growth potential.

In the period from December 2023 to February 2024, 31% of Bakersfield homebuyers explored options outside the city, while 69% preferred to remain within the metropolitan area. Notably, 0.51% of homebuyers nationwide expressed interest in relocating to Bakersfield, with Los Angeles, San Francisco, and Dallas emerging as the top origins for inbound migration.

Bakersfield Housing Market Forecast for 2024 and 2025

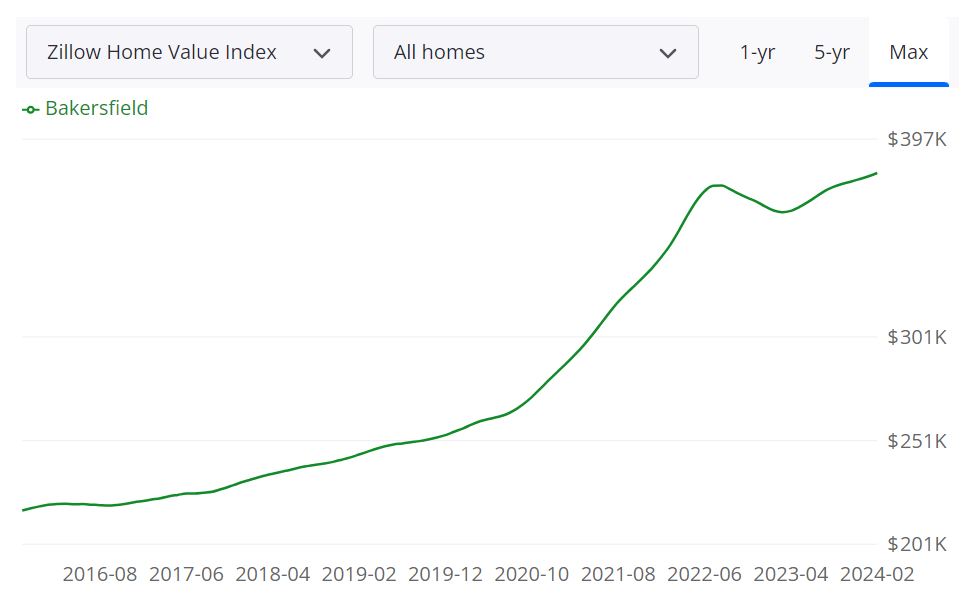

According to Zillow, the average home value in Bakersfield stands at $380,862, reflecting a 5.0% increase over the past year. Homes in this area typically go pending within approximately 20 days, indicating a fast-paced market environment.

Examining the inventory data, there were 770 homes for sale as of February 29, 2024, with 279 new listings added during the same period. These figures provide valuable insights into the supply side of the market, influencing factors such as pricing and competition.

Another essential metric is the median sale to list ratio, which was 1.000 as of January 31, 2024. This ratio indicates the relationship between the final sale price of a home and its initial listing price, offering valuable insights into negotiation dynamics.

Further dissecting the data, the median sale price in Bakersfield was $358,333 as of January 31, 2024, while the median list price stood at $404,960 as of February 29, 2024. Additionally, 34.1% of sales occurred over the list price, compared to 41.6% under the list price, underscoring the varied nature of transactions within the market.

Bakersfield MSA Housing Market Forecast

Looking ahead, the Bakersfield Metropolitan Statistical Area (MSA) housing market forecast provides valuable insights for both buyers and sellers. As of February 29, 2024, the forecast indicates a 0.5% increase in housing prices by March 31, 2024, followed by a projected 1.3% rise by May 31, 2024, and a 2.1% increase by February 28, 2025.

The Bakersfield MSA, encompassing various counties in California, including Kern County, represents a substantial housing market characterized by diverse offerings and competitive dynamics. Its significance extends beyond geographical boundaries, influencing regional economic indicators and development initiatives.

Is Bakersfield a Buyer’s or Seller’s Housing Market?

Assessing whether the current state of the Bakersfield housing market favors buyers or sellers requires a multifaceted analysis of various factors, including inventory levels, pricing trends, and market dynamics. With 770 homes for sale and a median sale to list ratio of 1.000, indicating a balanced relationship between listing and sale prices, the market appears to offer opportunities for both buyers and sellers.

However, the fast-paced nature of the market, with homes typically going pending within 20 days, suggests a competitive environment that may lean slightly towards sellers. Additionally, the 5.0% year-over-year increase in average home value indicates growing demand, which could further tip the scales in favor of sellers.

Are Home Prices Dropping in Bakersfield?

As of the latest data available, there is no indication of a significant drop in home prices in the Bakersfield area. In fact, the 5.0% increase in average home value over the past year suggests a trend of appreciation rather than depreciation. While market conditions can evolve rapidly, the current data does not suggest a widespread decline in home prices.

Will the Bakersfield Housing Market Crash?

The possibility of a housing market crash is a concern for both industry professionals and consumers alike. While it’s impossible to predict future market fluctuations with certainty, current indicators in the Bakersfield housing market do not point towards an imminent crash.

The steady appreciation in home values, coupled with consistent demand and moderate inventory levels, suggests a stable market environment. However, external factors such as economic shifts or unforeseen events could impact market dynamics, highlighting the importance of monitoring trends and staying informed.

Is Now a Good Time to Buy a House in Bakersfield?

For prospective homebuyers considering entering the Bakersfield housing market, the decision to buy ultimately depends on individual circumstances and long-term goals. While market conditions currently appear favorable, with a balanced inventory and competitive pricing, it’s essential to conduct thorough research and consider factors such as personal finances, employment stability, and future plans.

Bakersfield Real Estate Investment Overview

Bakersfield Home Appreciation: A Decade of Above-Average Growth

Over the last ten years, Bakersfield has experienced a noteworthy trend in home appreciation rates, surpassing the national average. According to data from NeighborhoodScout, the cumulative appreciation rate for homes in Bakersfield during this period stands at an impressive 110.25%. This places Bakersfield’s real estate market in the top 30% nationwide in terms of overall appreciation.

Breaking down the figures, Bakersfield has seen an annual average house appreciation rate of 7.71% over the past decade. This consistent and above-average growth reflects the city’s robust real estate market, making it an attractive destination for homeowners and investors alike.

Population Growth and Trends

Bakersfield, with its strategic location in California’s Central Valley, has experienced consistent population growth over the years. The city’s population trends indicate a steady increase, which is a positive sign for real estate investors seeking areas with a potential demand for housing.

- Population Dynamics: The city’s diverse population contributes to a dynamic real estate market, catering to various housing preferences.

- Migration Patterns: Analyzing migration patterns reveals a consistent influx of residents, creating a stable demand for housing options.

Economy and Jobs

The economic landscape of Bakersfield is a crucial factor for real estate investors. Understanding the city’s economy and job market is pivotal for making informed investment decisions.

- Job Opportunities: Bakersfield’s economy is anchored in industries like agriculture, oil, and manufacturing, providing a diverse range of job opportunities.

- Employment Stability: The stability of key industries contributes to a resilient job market, fostering economic stability that positively impacts the real estate sector.

Livability and Other Factors

Livability is a key consideration for both residents and investors. Factors such as amenities, education, and safety contribute to the overall appeal of the Bakersfield real estate market.

- Amenities: Bakersfield boasts a range of amenities, including parks, cultural attractions, and recreational facilities, enhancing the overall quality of life for residents.

- Educational Institutions: The presence of reputable educational institutions is a crucial factor, attracting families and students, positively influencing the demand for housing.

- Safety Measures: A focus on safety and community well-being adds to the city’s appeal, making it an attractive destination for potential real estate investors.

- Affordability: The cost of living in Bakersfield is significantly lower than the California average, attracting businesses and residents alike.

Rental Property Market Size and Growth

For investors interested in rental properties, analyzing the market size and growth potential is essential to maximize returns on investment. The city’s housing landscape is diverse, catering to both homeowners and renters, with 59.27% owning their residences and 40.73% opting for rental accommodations.

- Market Size: Bakersfield’s rental property market has shown substantial growth, with a diverse range of rental options catering to various tenant demographics.

- Rental Demand: Factors like job opportunities and population growth contribute to a sustained demand for rental properties, creating a lucrative market for investors.

- Single-family Detached Homes: When it comes to housing types, single-family detached homes dominate the Bakersfield real estate scene, constituting a significant 71.35% of the city’s housing units. Other prevalent housing options include large apartment complexes or high-rise apartments (13.40%), duplexes, homes converted to apartments, or other small apartment buildings (9.06%), and a small percentage of row houses and other attached homes (3.39%).

Other Factors Related to Real Estate Investing

Several additional factors play a role in the attractiveness of the Bakersfield real estate market for investors.

- Infrastructure Development: Ongoing and planned infrastructure projects can positively impact property values, making it a promising prospect for long-term investors.

- Market Affordability: Bakersfield’s real estate market offers affordability compared to some other California cities, making it an enticing option for investors looking for reasonable entry points.

In summary, the Bakersfield real estate market presents a compelling opportunity for investors. With a growing population, diverse economy, and favorable livability factors, the city offers a robust environment for real estate growth and profitability.

References:

- https://www.zillow.com/fresno-ca/home-values

- https://www.redfin.com/city/6904/CA/Fresno/housing-market

- https://www.macrotrends.net/cities/22927/bakersfield/population

- https://www.neighborhoodscout.com/ca/fresno/real-estate